Washington – Rep. Keith Ellison (D-MN) introduced the HBCU Investment Expansion Act, which would allow municipal bonds issued by HBCUs to have triple tax-exempt status (local, state, and federal).

A recent study by Drexel, the University of Notre Dame, Duke University, and University of California San Diego found that HBCUs pay more in fees to raise funds through bonds and that HBCUs may be forced to sell their bonds at a discount.

The HBCU Investment Expansion Act would increase competition and lower prices for these bonds.

“We all know how important our HBCUs are, and why they’re important,” said Rep. Ellison. “They offer a place for students to get an excellent education and set themselves up for success. Unfortunately, that costs money. While HBCUs are able to raise money by issuing bonds, researchers found that these universities face higher costs compared to other universities trying to raise funds with bonds. That’s not right. This legislation will level the playing field and help HBCUs get the funds they need to build new dorms, labs or classrooms without additional costs or fees.”

“Historically Black Colleges and Universities, like any other institution of higher learning, should be able to efficiently invest in their schools and support their students,” said Rep. Adams. “With more HBCUs in my home state than any other state in our nation, I am proud to support Congressman Ellison in our shared effort to eliminate the barriers that HBCUs face.”

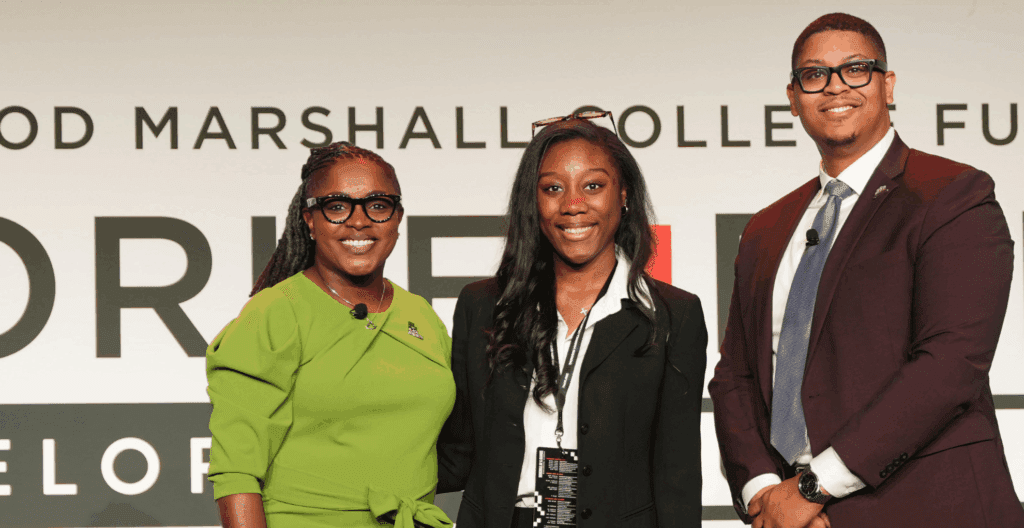

“We appreciate Congressman Ellison and his sponsorship of the HBCU Investment Expansion Act. This legislation is critical to help HBCUs gain increased access to the investment market,” said Johnny C. Taylor, Jr., President and CEO, The Thurgood Marshall College Fund.

“UNCF and our 37-member institutions stand in full support of the HBCU Investment Expansion Act and we applaud Congressman Ellison’s strong leadership in crafting this legislation,” said Cheryl L. Smith, UNCF Senior Vice President of Public Policy and Government Affairs. “This innovative bill will help redress recently revealed and grievous inequities that HBCUs face in accessing financing in the private bond markets for critical infrastructure projects. We urge its swift passage by the Congress.”

The legislation is co-sponsored by Rep. Alma S. Adams (D-NC), Ranking Member Bobby Scott (D-VA), Ranking Member Maxine Waters (D-CA), and Rep. Barbara Lee (D-CA).